17 Best Bitcoin Lending Sites In 2024

[Tested & Reviewed]

Are you looking for a quick way to obtain Bitcoin?

You may have noticed the evolution of cryptocurrency and are feeling a bit left out.

We are here for you with our list of the best Bitcoin lending sites that can give you an idea of how to you invest in this flagship digital currency. To give you a clearer picture of the options on the market, we have contacted some of the major companies that offer these services directly.

Here you will learn about…

- The top lending sites currently on the market

- A detailed list of the Pros and Cons of each lending site

- A comprehensive buyer’s guide to help you make your decision

- The fastest way to obtain Bitcoin loans.

Which are the top Bitcoin lending sites in 2022?

Last Updated: March 22, 2023

Top 17 Bitcoin Lending Sites 2024

1. CoinRabbit

CoinRabbit is a peer-to-peer platform that allows users to earn interest and receive crypto-backed loans in stablecoins. Lack of platform fees, unlimited loan terms, and accessibility are some of the reasons why crypto enthusiasts are fond of the marketplace. If you value operational flexibility, then CoinRabbit is for you. Full Review

- No KYC

- Simplicity

- Great crypto adoption

CoinRabbit is a peer-to-peer platform that allows users to earn interest and receive crypto-backed loans in stablecoins. Lack of platform fees, unlimited loan terms, and accessibility are some of the reasons why crypto enthusiasts are fond of the marketplace. If you value operational flexibility, then CoinRabbit is for you. Full Review

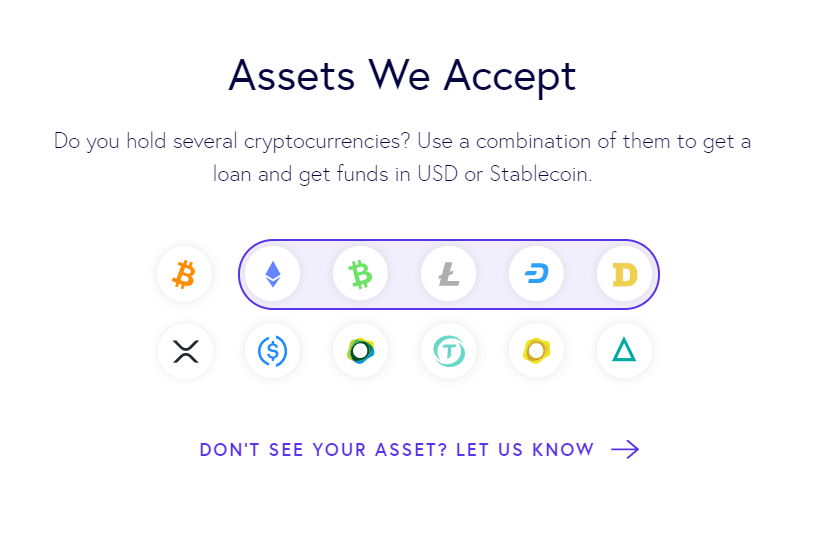

2. Salt

Based in Denver, Colorado, SALT is a blockchain company that offers crypto-backed loans. The platform is flexible, with a range of crypto coins accepted as collateral and LTV options ranging from 20% to 70%. Moreover, the company doesn’t charge any origination and prepayment fees. Full Review

- No origination nor prepayment fees

- Long loan tenor of 12 to 60 months

- Option to choose stablecoin payouts

Based in Denver, Colorado, SALT is a blockchain company that offers crypto-backed loans. The platform is flexible, with a range of crypto coins accepted as collateral and LTV options ranging from 20% to 70%. Moreover, the company doesn’t charge any origination and prepayment fees. Full Review

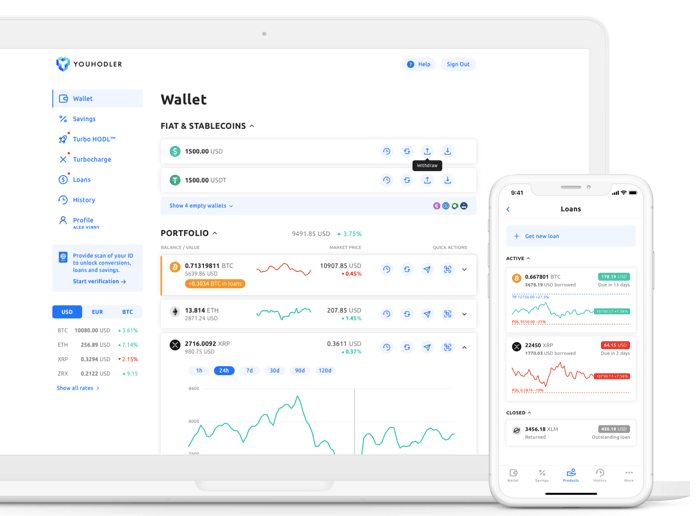

3. YouHodler

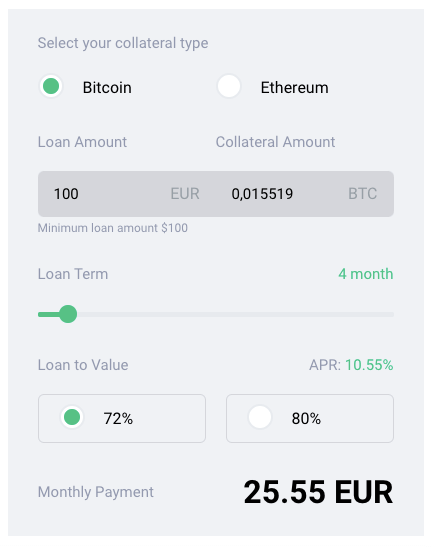

Launched in 2018, YouHodler is a Swiss-based fintech company that lets its customers take out crypto-backed fiat, crypto, and stablecoin loans. Loan terms range from 30 to 180 days, interest rates start at 2.5%, there are no additional platform charges, and applications are processed almost instantly. Full Review

- Minimum loan amount is $100

- LTV goes up to 90%

- 24/7 support via live chat and email

Launched in 2018, YouHodler is a Swiss-based fintech company that lets its customers take out crypto-backed fiat, crypto, and stablecoin loans. Loan terms range from 30 to 180 days, interest rates start at 2.5%, there are no additional platform charges, and applications are processed almost instantly. Full Review

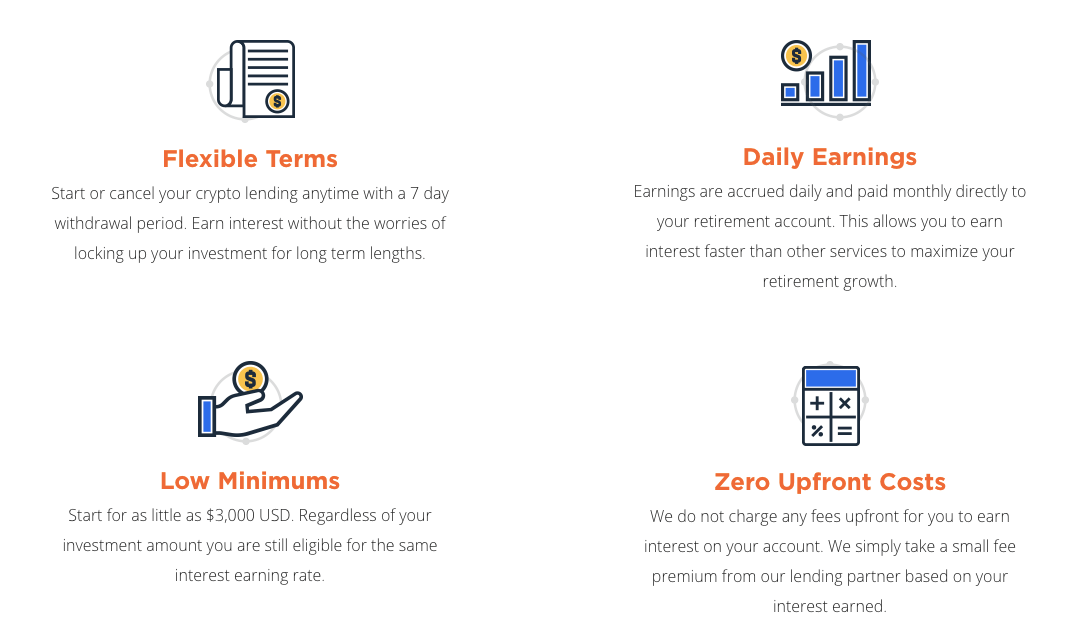

4. Bitcoin IRA

Bitcoin IRA was established in 2018 as one of the first companies to offer a full-service solution that allows you to invest in cryptocurrencies for retirement. In partnership with Genesis Global, a Delaware-based LLC, the company has also developed a lending program that its clients can use to earn passive income on their crypto assets. Full Review

- Supports multiple cryptocurrencies

- Fast application process

- High level of security

Bitcoin IRA was established in 2018 as one of the first companies to offer a full-service solution that allows you to invest in cryptocurrencies for retirement. In partnership with Genesis Global, a Delaware-based LLC, the company has also developed a lending program that its clients can use to earn passive income on their crypto assets. Full Review

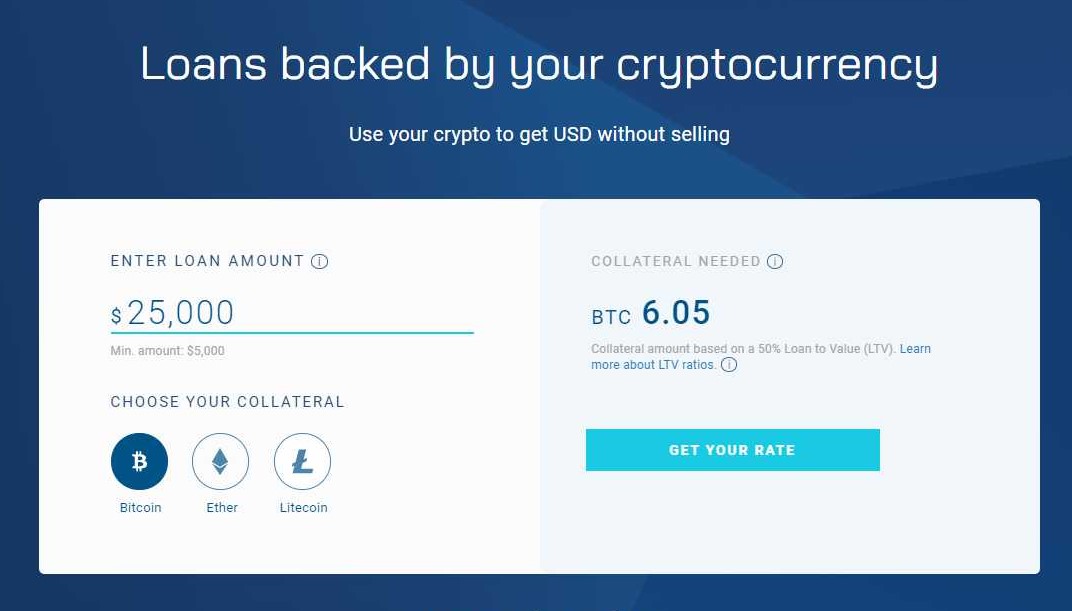

5. BlockFi

Opening an account with BlockFi can be done in a couple of easy steps. Before you know it, you will start earning up to 8.6% of interest annually. BlockFi lets your crypto do the work for you by allowing you to lend Bitcoin for interest and earn monthly payments in the deposited asset type. You can earn compound interest in crypto, resulting in increasing your assets. Full Review

- High-yielding account available to non-US users

- Loan duration: 12 months

- Lenders can withdraw at any time

Opening an account with BlockFi can be done in a couple of easy steps. Before you know it, you will start earning up to 8.6% of interest annually. BlockFi lets your crypto do the work for you by allowing you to lend Bitcoin for interest and earn monthly payments in the deposited asset type. You can earn compound interest in crypto, resulting in increasing your assets. Full Review

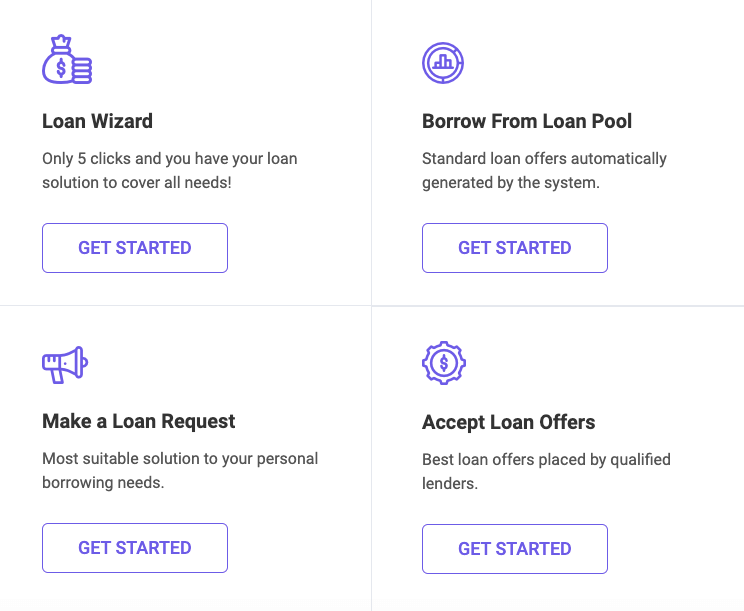

6. LendaBit

LendaBit is a peer-to-peer lending marketplace that offers crypto-backed loans. If you are looking to take out a Bitcoin- or Ether-backed loan in Tether with a term length of one day to three years and don’t mind the withdrawal and system fees, this may be the place for you. Full Review

- 0% interest for the first 45 days

- No prepayment penalties

- Wallet services provided by BitGo

LendaBit is a peer-to-peer lending marketplace that offers crypto-backed loans. If you are looking to take out a Bitcoin- or Ether-backed loan in Tether with a term length of one day to three years and don’t mind the withdrawal and system fees, this may be the place for you. Full Review

7. BtcPop

BtcPop allows for a quick Bitcoin income by getting loans from other members or loaning it yourself. It offers easy-to-use services that result in your getting the assets you need. They deal with multiple currencies and even offer new rising altcoins. Full Review

- Lenders can withdraw at any time

- Deposit limit: No deposit limit

- Accepts multiple cryptocurrencies

BtcPop allows for a quick Bitcoin income by getting loans from other members or loaning it yourself. It offers easy-to-use services that result in your getting the assets you need. They deal with multiple currencies and even offer new rising altcoins. Full Review

8. CoinLoan

CoinLoan has a lot to offer to any investor with significant crypto holdings and eager borrowers. It challenges traditional financing by combining cryptocurrency and crowdfunding, allowing individuals to borrow funds with a loan-to-value (LTV) of up to 70%. While those looking to gain passive income can get double-digit returns both by funding investments with stable and fiat currencies. Full Review

- Loan duration: from 7 days to 36 months

- Lenders can withdraw money at any time

- Platform charges: No fees

CoinLoan has a lot to offer to any investor with significant crypto holdings and eager borrowers. It challenges traditional financing by combining cryptocurrency and crowdfunding, allowing individuals to borrow funds with a loan-to-value (LTV) of up to 70%. While those looking to gain passive income can get double-digit returns both by funding investments with stable and fiat currencies. Full Review

9. Nexo

Nexo offers one of the safest ways to loan crypto. All accounts are insured by digital asset security expert BitGo, allowing all transactions to be conducted safely. You can view Nexo as the most secure platform that allows you to instantly borrow 40+ cryptocurrencies. It further lets you earn Nexo Bitcoin interest in idle assets. Full Review

- No deposit limit

- Interest rate: Up to 16% APR

- Accepts multiple cryptocurrencies

Nexo offers one of the safest ways to loan crypto. All accounts are insured by digital asset security expert BitGo, allowing all transactions to be conducted safely. You can view Nexo as the most secure platform that allows you to instantly borrow 40+ cryptocurrencies. It further lets you earn Nexo Bitcoin interest in idle assets. Full Review

10. Binance

Binance is a legitimate platform that provides primarily Bitcoin purchases while also dealing with lending cryptocurrency at a very favorable BTC price. You can choose from a wide suite of crypto options. The platform also lets you hold your funds and gain interest, and make flexible deposits at your convenience. Either way, Binance helps you make good use of your assets. Full Review

- Annual interest rate 8.90%

- Deposit limit: No limit

- Accepts multiple cryptocurrencies

Binance is a legitimate platform that provides primarily Bitcoin purchases while also dealing with lending cryptocurrency at a very favorable BTC price. You can choose from a wide suite of crypto options. The platform also lets you hold your funds and gain interest, and make flexible deposits at your convenience. Either way, Binance helps you make good use of your assets. Full Review

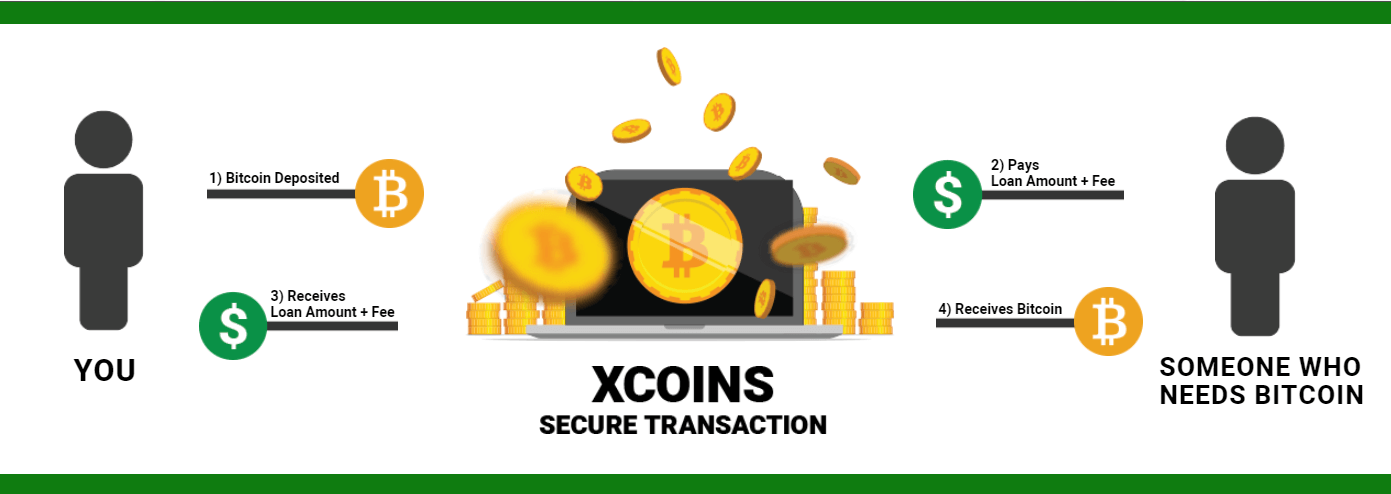

11. xCoins

xCoins services are specifically developed to cater to those who want to bypass the usual problems that occur when trying to obtain Bitcoin. Forget about other unsecured Bitcoin loans and utilize the services of xCoins and find or get matched with potential borrowers or lenders fast. Full Review

- Lenders can withdraw money at any time

- Deposit limit: Not limit

- Accepts multiple cryptocurrencies

xCoins services are specifically developed to cater to those who want to bypass the usual problems that occur when trying to obtain Bitcoin. Forget about other unsecured Bitcoin loans and utilize the services of xCoins and find or get matched with potential borrowers or lenders fast. Full Review

12. Kiva

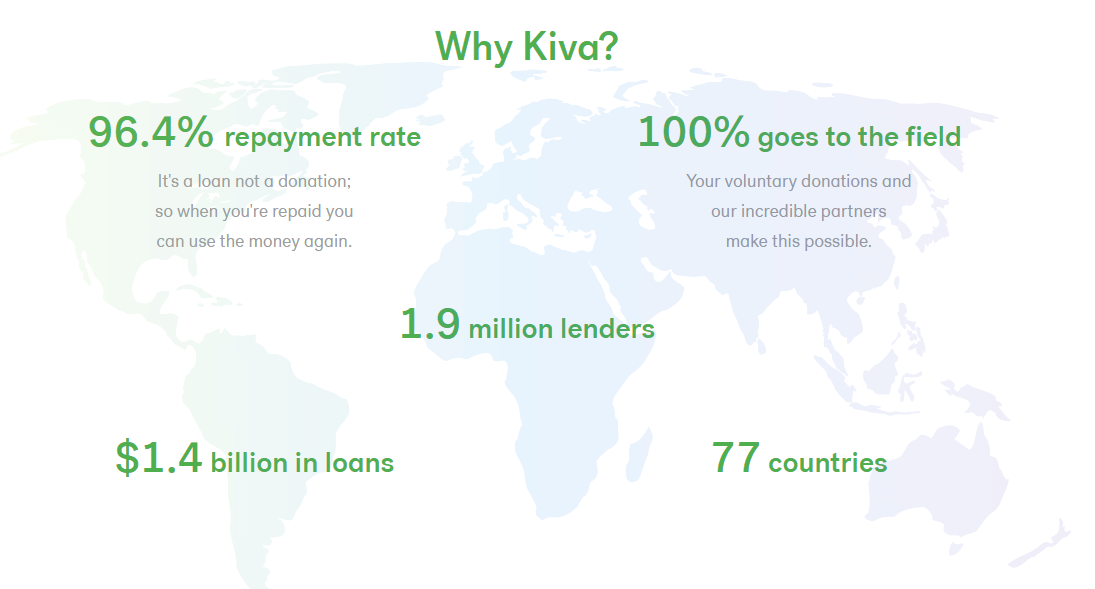

Kiva is there to provide anonymous Bitcoin loan options to those that need them the most. Communities in need around the world can truly benefit from their program. Kiva offers flexible loan terms and capital to enable stability. Full Review

- Lenders can withdraw money at any time

- Accepts multiple currencies

- Interest rate: Depending on the borrower

Kiva is there to provide anonymous Bitcoin loan options to those that need them the most. Communities in need around the world can truly benefit from their program. Kiva offers flexible loan terms and capital to enable stability. Full Review

13. SpectroCoin

Launched in 2013, SpectroCoin is a London-based all-in-one solution for cryptocurrencies. In addition to cryptocurrency loans, the company offers an electronic wallet, a prepaid debit card, currency exchange, a cryptocurrency brokerage, and merchant tools. The platform accepts multiple cryptocurrencies and offers relatively affordable interest rates. Full Review

- Competitive loan terms

- No prepayment penalties

- Easy application process

Launched in 2013, SpectroCoin is a London-based all-in-one solution for cryptocurrencies. In addition to cryptocurrency loans, the company offers an electronic wallet, a prepaid debit card, currency exchange, a cryptocurrency brokerage, and merchant tools. The platform accepts multiple cryptocurrencies and offers relatively affordable interest rates. Full Review

14. Nebeus

Launched in 2014, Nebeus has quickly grown to offer an array of cryptocurrency-related products and services, such as instant crypto-backed loans, an online wallet, savings accounts, cold vault storage, and the ability to buy and sell cryptocurrencies. As far as loans go, the company charges 0% on loan terms of up to 12 months. Full Review

- 72%- 80% loan-to-value ratio

- Loan Health Monitor

- Flexible repayment options

Launched in 2014, Nebeus has quickly grown to offer an array of cryptocurrency-related products and services, such as instant crypto-backed loans, an online wallet, savings accounts, cold vault storage, and the ability to buy and sell cryptocurrencies. As far as loans go, the company charges 0% on loan terms of up to 12 months. Full Review

15. Unchained Capital

Unchained Capital is a Texas-based blockchain financial services company that offers crypto-collateralized loans. The company specializes in offering cash loans to long-term cryptocurrency holders backed by an innovative multi-signature cold-storage custody solution. Full Review

- Quick and easy online application process

- Funds are available almost instantly

- Commercial loans are available worldwide

Unchained Capital is a Texas-based blockchain financial services company that offers crypto-collateralized loans. The company specializes in offering cash loans to long-term cryptocurrency holders backed by an innovative multi-signature cold-storage custody solution. Full Review

16. KuCoin

Launched in 2017, KuCoin has quickly become one of the global leaders among exchange platforms for digital assets and cryptocurrencies. In addition to convenient and secure exchange services, the site also offers short-term loans with competitive interest rates. Full Review

- A wide range of accepted cryptocurrencies

- Loan-to-value ratio goes up to 100%

- Quick and easy application

Launched in 2017, KuCoin has quickly become one of the global leaders among exchange platforms for digital assets and cryptocurrencies. In addition to convenient and secure exchange services, the site also offers short-term loans with competitive interest rates. Full Review

17. CoinList

CoinList provides a platform for digital asset companies to run their token sales. The California-based company has also recently launched CoinList Lend, an easy-to-use service geared towards clients looking to earn a passive return on their digital assets. Full Review

- Accepts 10 different cryptocurrencies

- Borrowers and lenders remain anonymous

- Quick-to-respond customer support

CoinList provides a platform for digital asset companies to run their token sales. The California-based company has also recently launched CoinList Lend, an easy-to-use service geared towards clients looking to earn a passive return on their digital assets. Full Review

2022’s Bitcoin Lending Sites

Our list of best Bitcoin lending sites is based on our personal opinion and experience with the platforms, backed by our custom methodology. By carefully analyzing the market and what it offers we have come up with this curated list of platforms:

- CoinRabbit – the best platform for long-term stablecoin loans

- Salt – The only site that provides next-gen protection and even offers crime insurance to safeguard your digital assets.

- YouHodler – Excellent option for crypto-backed short-term loans; available in crypto, stablecoins or fiat.

- Bitcoin IRA – A full-service solution that lets you invest in cryptocurrencies for retirement.

- BlockFi – Lets you borrow in fiat against your crypto assets.

- LendaBit – 0% interest for the first 45 days and no prepayment penalties.

- BtcPop – A platform that solely grants loans based on the user’s reputation and not credit score.

- CoinLoan – A leading P2P crypto asset-lending platform with advanced technology and above-average security.

- Nexo – One of the safest platforms currently available.

- Binance – One of the leading crypto exchange platforms that also offers crypto lending and the ability to choose among 100 different coins available.

- xCoins – The only service that makes their transactions possible through PayPal.

- Kiva – The only platform that offers 0% interest but only helps the ones that really need the assets.

- SpectroCoin – Best for those looking to repay the loan in less than a year.

- Nebeus – Excellent option for high loan-to-value ratios.

- Unchained Capital – Backed by an innovative multi-signature cold-storage custody solution.

- KuCoin – Accepts a long list of different cryptocurrencies.

- CoinList – Great choice for loan terms under 30 days.

Detailed Reviews

- Free Trial: No

- Lenders can withdraw any time: Yes

- Platform charges: No fees

- Loan duration: Unlimited

- Interest rates: 12%-16% APR

- Deposit limit: Minimum $100, Maximum $1 million

- Accepts multiple cryptocurrencies: Yes

Founded in 2020 and headquartered in Tallinn, Estonia, CoinRabbit is widely considered to be among the most flexible crypto platforms. The marketplace has no KYC procedures and processes loans promptly. It currently supports 80 cryptocurrencies for stablecoin loans.

How to Apply

CoinRabbit does not have any Know Your Customer (KYC) procedures. All you need to do when applying for a loan is to verify your contact details through a code.

Once this is done, go to CoinRabbit’s website and click on the “loans” option.

The first step you will take is to calculate your crypto loan. Notably, the platform offers several loan-to-value ratio (LTV) options – 50%, 60%, 70%, and 80%. This means you can borrow $2,000 with collateral as low as $2,500. Bear in mind, though, that the higher the LTV, the higher the margin call.

After selecting the most suitable LTV option for you and specifying the loan terms, you will need to provide your payout address and confirm it by phone or email.

CoinRabbit processes loans within a few minutes. If you have submitted your collateral, it shouldn’t take long. The funds will be sent to your address once the loan is approved.

Since CoinRabbit’s loan tenor is unlimited, you can pay back your loan at a time of your convenience and repossess your collateral.

Things We Liked and Things We Didn’t Like

For any investor, an opportunity to invest safely and get returns on crypto is an exciting proposition. CoinRabbit offers up to 10% Annual Percentage Yield (APY), but most deposits gain 8% APY.

CoinRabbit also helps users manage the value of their collateral in case of fluctuations. The platform achieves this by showing several statuses by the level of risk before the actual margin call happens.

We also liked the unlimited loan periods. This can be a huge asset for market-savvy users.

That said, there are also some aspects we didn’t particularly fancy.

When you take a crypto loan from the platform, you can’t receive loan funds in fiat.

Borrowers also incur high-interest rates. Sometimes as high as 16% Annual Percentage Rate (APR).

Lastly, CoinRabbit does not insure deposits.

Support

This is one of the areas that potential users need not worry about. CoinRabbit has robust customer support structures. Options to get in touch with the team include email, live chat, direct online message, and social media chat.

Pricing/Fees

CoinRabbit styles itself as a platform that makes it easy for borrowers and lenders to make their moves.

Consequently, the platform does not charge any deposit or withdrawal fees.

The Annual Percentage Return (APR) on crypto loans ranges between 14% and 16%.

On the other hand, most deposits gain an 8% Annual Percentage Yield (APY), which is higher than what most competitors offer.

| Pros | Cons |

| No KYC | Deposits are not insured |

| Simplicity | Doesn’t support fiat currencies |

| Great crypto adoption (80+ coins as collateral) | No mobile app |

| No time limits on loan repayments | |

| Sound customer support structures | |

| Loans as low as 100 USDT |

Our Verdict

Every crypto enthusiast is always looking for the best solutions. CoinRabbit is one of the most promising crypto lending platforms offering convenience and flexibility. If you are looking for a reliable, fast-growing crypto lending site, CoinRabbit should be among your first picks.

Reasons to Use

No KYC, simplicity, anonymity, and great crypto adoption make CoinRabbit worth a look.

- Free trial: No

- Lenders can withdraw money at any time: Yes

- Platform charges: No origination nor prepayment fees

- Loan duration: 12 to 60 months

- Interest rate: Starting from 0.52%

- Deposit limit: No deposit limit

- Accepts multiple cryptocurrencies: Yes.

Founded in 2016 in Denver, Colorado, SALT is a next-gen crypto lending platform. The abbreviation SALT stands for “Secured Automated Lending Technology.” You can also recognize SALT by its tagline: “Hold your assets, spend your cash.”

How to Apply

Applying for a loan on SALT is easy. The first step is creating an account. After that, you must select your borrowing preferences and submit your loan application. The next step is to deposit your collateral. To do this, you’ll send your assets to a unique multi-signature SALT collateral wallet.

Once approved, you’ll receive your loan amount directly to your account in USD, TUSD, PAX or USDC.

When you pay back the loan, the collateral will be sent back to you. If you default, the investor gets to keep it.

Things We Liked & Things We Didn’t Like

The fact that SALT is regulated and maintains compliance is something that boasts well for the platform.

The loan terms are competitive, and there’s a compelling business loan option. The minimum loan amount is just $1,000, while the maximum goes over $1 million, meeting different users’ needs. In addition, the security and professionalism are on a high level.

However, there are some limitations. Loans are only available in USD and like-kind stablecoins USDC, TSUD, and PAX. While the company plans to introduce more crypto and national currencies, the current options lack behind those offered by competitors.

Support

The support team gets high marks for their speedy responses and professionalism. Quick to answer and easy to understand.

Pricing/Fees

To determine the fees on the SALT platform, it is best to use the lending calculator provided on the site. Many factors will determine the interest fees, including the amount of money and the loan worth, the duration for repayment, the location, etc.

There are no late monthly fees nor withdrawal fees imposed. The only fees are those that are added to transactions for network facilitation.

| Pros | Cons |

| Accepts a wide range of cryptocurrencies as collateral | Certain loans may incur higher repayment rates than banks |

| A combination of different cryptocurrencies can be used to stake collateral for a loan | Only dollar-denominated loans available |

| Cyber liability and crime insurance for insuring client’s funds | |

| Very user-friendly and comprehensive platform as well as responsive support service |

Our Verdict

SALT is a legitimate and professional platform for crypto-backed loans for business, personal and household purposes. The loan terms are highly-customizable and competitive. In addition, SALT’s mobile app, real-time notifications, and 24/7 support make the service convenient and easy to use.

The fact that SALT loans are in high demand in the crypto-community speaks a lot about the company.

Every crypto investor and borrower is always looking for the safest platform and best terms possible. Salt Lending offers both and features at the top end of the spectrum amongst its peers.

Reasons to Use

There are no credit checks, and the platform allows a combination of different cryptos as collateral. Also, user funds are insured and safely stored in multi-sig wallets for improved security.

- Free trial: No

- Platform charges: No fees

- Interest rate: 1%- 13.50%

- Accepts multiple cryptocurrencies: Yes

- Lenders can withdraw money at any time: Yes

- Loan duration: 30, 60, or 180 days (extendable)

- Deposit limit: Not stated

Founded in 2018, YouHodler is a Swiss-based fintech company that offers a variety of high-quality services to help you manage your digital assets. As one of the best cryptocurrency lending sites, YouHodler lets its customers take out crypto-backed fiat, crypto, and stablecoin loans and it processes requests almost instantly.

How to Apply

Getting started with YouHodler is quick and easy. First of all, you’ll need to set up your account and provide scans of your ID to verify it. From there, you’ll be able to make a deposit and request a cash or crypto loan using your preferred collateral. You won’t need to wait for more than a few seconds for loan approval. Upon its completion, the agreed-upon borrowing amount will be added to your wallet.

The options to cash out a loan include bank wire transfer and credit card withdrawal. Those who take out loans in cryptocurrency can use YouHodler’s exchange feature to convert it to Bitcoin or altcoins, stablecoins, or fiat.

Things We Liked & Disliked

YouHodler is an official Blockchain Association member. The provider dominates the crypto loan market with a loan-to-value ratio of up to 90% on a range of 50+ crypto coins. It also offers crypto-backed loans in the form of cash and cryptocurrency itself, with a minimum amount of $100 or the equivalent.

Moreover, in addition to repaying the loan, users are presented with three more exit strategies (close without repaying, manage loan duration, or walk away with 85% of your asset value on 90% LTV loans).

As far as drawbacks go, interest rates on long-term loans tend to be high. Also, YouHolder’s services aren’t available to customers from the United States.

Support

YouHodler’s customer support team is available round the clock via live chat or email. The site also has a comprehensive help page.

Pricing/Fees

YouHodler provides three types of crypto loan packages. Interest rates are determined by the term and loan-to-value (LTV) ratio you decide on. On a loan with a 30-day term and a 90% LTV ratio, customers are charged a 2.5% interest rate; if you opt for a 60-day loan term and a 70% LTV ratio, you’ll have to face a 3.20% interest rate; with a 180-day term and a 50% LTV ratio, you’ll have to pay a 8% interest fee.

| Pros | Cons |

| Loan funds available in cryptocurrency, stablecoins, or fiat | Longer-term loan options come with high-interest rates |

| The minimum loan amount is $100 or the equivalent | Services not available for US citizens |

| Loan-to-Value Ratio up to 90% | |

| 24/7 support via live chat and email |

To put it simply – the longer the loan term, the lower the LTV, and the higher the interest rates. What makes YouHodler stand out from the competition is that it doesn’t calculate interest based on loan amount and collateral. The fees are only determined by the loan type and the same interest is charged to all users.

Our Verdict

Crypto lending platforms are becoming increasingly popular among investors as they provide a strategic tool for hedging and leveraging assets. YouHodler offers a great service in this respect – provided that you are looking for a short-term cash flow solution. Given that its interest rates on long-term loans are somewhat high, we suggest you explore other options if that’s what you’re after.

Reasons to Use

If you’re looking to get crypto or fiat loans collateralized by your crypto assets, you should give YouHodler a chance. The site offers three loan packages, a simple application process, an easy-to-use platform, and lighting-fast approvals.

- Free trial: No

- Platform charges: 2% transaction fee and 0.0008% maintenance fee

- Interest rate: Starting from 2%

- Accepts multiple cryptocurrencies: Yes

- Lenders can withdraw money at any time: Yes

- Loan duration: 3-12 months

- Deposit limit: The minimum is $3,000; there are no upper limits

As one of the first companies to offer a full-service solution that lets you invest in cryptocurrencies for retirement, Bitcoin IRA has drawn a lot of attention to itself since its founding date in March 2015. In partnership with Genesis Global, a Delaware-based LLC, Bitcoin IRA has also developed a lending program that its customers can use to earn passive income on their crypto assets.

How to Apply

Opening an account with Bitcoin IRA is quick and easy; getting started with a traditional, Roth, or rollover IRA takes no longer than a few minutes. Given that this platform focuses on lenders rather than borrowers, that’s also the way we’ve structured this Bitcoin lending site review.

As soon as you’ve opened your desired type of account and deposited at least $3,000, you’ll be able to start earning interest through Bitcoin IRA’s lending program.

Things We Liked & Disliked

One of the best things about this lending platform is that it is incredibly easy to use as its creators have managed to simplify otherwise complicated financial management tools. We also liked that Bitcoin IRA lets you trade and lend a long list of digital assets such as Bitcoin (BTC), Bitcoin Cash (BCH), Ripple (XRP), Litecoin (LTC), Ether (ETH), Ethereum Classic (ETC), Stellar Lumens (XLM), Zcash (ZEC), Bitcoin Cash (BCH), and Digital Gold (DG).

What we didn’t like is that the site doesn’t disclose much information from a borrower’s point of view. Those who’d like to learn more have to visit Genesis Global’s website.

Support

Should you have any questions or run into any issues, Bitcoin IRA’s helpful customer support representatives will be there to assist you. Note that you’ll get an instant answer if you get in touch with them via live chat or email during working hours. Alternatively, you can explore the site’s FAQ page.

Pricing/Fees

As one of the best lending sites for Bitcoin and other popular cryptocurrencies, Bitcoin IRA offers competitive loan terms. Interest rates start from 2%, while loan periods vary between three and 12 months. It’s also important to mention that both the lender and the borrower can cancel the agreement at any time. In that case, the assets will be available to transfer or liquidate after five to seven business days.

| Pros | Cons |

| Supports multiple cryptocurrencies | No round-the-clock support |

| Fast application process | The shortest loan term is three months |

| High level of security | |

| Competitive interest rates |

Our Verdict

Although the company has been around for less than three years, Bitcoin IRA has already processed more than $350 million in loans and investments for more than 4,000 clients. Thanks to its partnership with Genesis Global, a digital currency prime broker, this retirement investment platform is now also able to offer its clients another way to increase their savings – by offering crypto-backed loans. Still, if you’re not a fan of using an investment account to accumulate your retirement savings, Bitcoin IRA isn’t for you.

Reasons to Use

We recommend Bitcoin IRA for its transparency, simplicity, and high level of security. We also like that it supports 10 different digital assets.

- Free trial: No

- Lenders can withdraw money at any time: Yes

- Platform charges: 2% origination fee

- Loan duration: 12 months

- Interest rate: BTC Tier 1 (0-0.10 BTC) 3.50%, BTC Tier 2 (0.10 - 0.35 BTC) 2.50%, ETH Tier 1 > (0-1.5 ETH) 3.50%

- Deposit limit: No minimum nor maximum deposit limit

- Accepts multiple cryptocurrencies: Yes

Some would consider BlockFi one of the best crypto lending sites currently available. It was founded by Zac Prince and Flori Marquez in 2017. Since its inception the company has managed to raise over $20 from firms, including Coinbase Ventures.

BlockFi offers a crypto deposit account with compound interest. Meaning that the monthly interest earned goes back to the original pool and continues to compound. Currently, BlockFi has over $50 million of cryptocurrency stored by users that are being paid interest.

How to Apply

Opening up an account with BlockFi is fairly easy and can set you up with easy blockchain lending. You just have to go to their site and either find the “Earn Interest” or “Get Started” option. Add your email and password to create an account. A verification code will be sent to your mail address. After this, go to “Deposit” where you will confirm your identity and make your initial deposit.

You will finish the process by entering the necessary personal information about you. Finally, to be approved, upload a picture of a valid document (ID, passport or driver’s license).

Things We Liked & Things We Didn’t Like

Removing the early withdrawal penalty on its crypto interest account is a good move on BlockFi’s part. Additionally, we have to mention the zero-fee trading possibility. Allowing users to trade between various cryptocurrencies on the platform at zero cost.

That said, withdrawal fees on this platform are higher than most. In fact, you will have to be careful how much and how often you withdraw funds. Additionally, customers need to be careful and check the interest rates for different crypto assets as they do tend to vary often.

However, the most notable con is that BlockFi is no longer offering its Interest Accounts to US users. The company is experiencing regulatory issues in the US. To settle SEC charges, in February 2022, BlockFi agreed to bring its crypto lending product into compliance and pay $100 million in penalties.

Support

As far as their support team goes they are doing a good job. They seem to be responsive, and offer clear and helpful answers.

Pricing/Fees

We would say that BlockFi offers reasonable fees for their level of professionalism and reputation. The addition of one free withdrawal fee per month is also really helpful. Although it may be stifling for those who want more flexibility and don’t want to spend so much on added fees.

| Pros | Cons |

| Trade between different cryptocurrency at zero cost | High withdrawal fees than most |

| Offers monthly compound interest | They often adjust their interest rates |

| Earn interest in the asset of choice | Interest accounts only available to non US users |

| No minimum requirements to earn interest |

Our Verdict

BlockFi is definitely one of the better lending platforms out there. They are definitely making waves with the work they’re doing and are trying to get better at the same time. Reaching out to customers and improving their services is definitely something that makes them one of the best Bitcoin lending sites currently available.

That said, they do need to work on their withdrawal fees for an even better rating.

Reasons to Use

Professionalism, favorable interest rates and high security. The platform is improving and trying to make their services even better.

- Free trial: No

- Platform charges: Withdrawal fees, system fees

- Interest rate: 0.1%-100%

- Accepts multiple cryptocurrencies: Yes

- Loan duration: One day to three years

- Deposit limit: 0.025 BTC-535 BTC

LendaBit is a fintech startup that offers peer-to-peer crypto-backed loans. Launched with the idea to simplify the loan process and provide attractive terms to both lenders and borrowers, the company has quickly become well-known for offering a secure and well-structured lending platform. If you are looking to take out a Bitcoin- or Etherium-backed loan in Tether, LendaBit may be a good choice.

How to Apply

Applying for a peer-to-peer loan via LendaBit isn’t complicated at all – there are just a few simple steps that prospective borrowers are required to take.

To start the process, you’ll need to create and verify your account. From there, you’ll be asked to transfer your BTC or ETH assets to your LendaBit wallet. After making a deposit, you’ll be presented with three borrowing options. You can either choose an option from a loan pool with predefined parameters, opt for one of the investors’ loans that best suits your needs, or make an individual request stating the loan terms you’re comfortable with.

As soon as you choose the desired option, funds will be available for withdrawal. Note that you’ll receive the loan amount in USDT, however, the platform will let you exchange it to get fiat.

Things We Liked & Disliked

Although Lendabit is a relatively new Bitcoin lending site, the fact that it has partnered up with BitGo, a leading digital asset trust company, to provide wallet services increases its credibility. Moreover, Lendabit takes its users’ sensitive data very seriously. Thanks to the BitGo custodial services, multi-signature technology, and two-factor authentication, you can rest assured that your funds are well-protected at all times.

As far as drawbacks go, the range of supported cryptocurrencies is quite narrow in comparison with the options provided by LendaBit’s direct competitors. Also, there are no fiat loan options – customers can only withdraw the borrowed amount in USDT and exchange it for fit.

Support

As one of the best crypto borrowing platforms, LendaBit provides 24/7 multi-channel support. Options to get in touch with the site’s customer service team include phone, email, and contact form. There’s also a detailed FAQ page and a community live chat that all users can join.

Pricing/Fees

LendaBit is a peer-to-peer lending marketplace which means that the fees on loans provided via its platform start at 0.1% and can go up to 100%, although they mostly average between 5% and 15%. Additionally, all new clients get 0% interest for the first 45 days. There are also system fees (loan processing fees) and withdrawal fees. The minimum loan amount is 0.025 BTC, while the maximum is 535 BTC.

Users don’t need to worry about paying the interest on a weekly or monthly basis as all borrowing costs are charged at the end of the loan term. Also, note that there are no penalties nor benefits to repaying the USDT loan early.

| Pros | Cons |

| 0% interest for the first 45 days | Low liquidity as the site is fairly new |

| No prepayment penalties | Very few user reviews |

| Interest is paid at the end of the loan term | |

| Wallet services provided by BitGo |

Our Verdict

LendaBit is a lending marketplace that connects funding providers that offer crypto-backed loans with prospective borrowers. The site offers a nice range of loan types – customers can either request funding under their terms or choose some of the predetermined options for the loan pool. However, given that its platform was launched in 2019, LendaBit’s liquidity is still low and there are very few user reviews about it online. In conclusion, if you’d rather apply for a Bitcoin loan via a more established platform, we suggest you explore other options.

Reasons to Use

The 0% interest for the 45-day promo period, high level of security, flexible repayment options, and partnership BitGo make LendaBit worth a second look.

- Free trial: No

- Lenders can withdraw money at any time: Yes

- Platform charges: There are multiple fees included. Loan fees for listing are 1%, while Late loan fees are 2%.

- Loan duration: Members can choose the length of a loan repayment starting from one week. It is all based on reputation and members can make monthly payments until the return the entire borrowed amount.

- Interest rate: High Collateral 10-15% APR; Medium Collateral 15-25%; Low Collateral 20-45%; No Collateral 50%+ APR. However, in most situations, members will set an interest rate based on reputation.

- Deposit limit: No deposit limit

- Accepts multiple cryptocurrencies: Yes

BTCpop was created in 2014 and is headquartered in East Sussex, UK. It is recognized as one of the first websites that offer peer-to-peer lending for Bitcoin. Currently, it has a total volume of around $1 million and 20,000 users spread across 60+countries.

This is also one of the few platforms that offer loans in Bitcoin, rather than being backed up by cryptocurrency. BtcPop Bitcoin lending is based on online reputation and clients are not deemed eligible on their credit score. Part of the borrower’s credibility gets is also based on the repayment history on the platform. So if you are thinking about investing there, you should consider using it in the long term.

How to Apply

Applying for a loan with BtcPop requires you to create an account and get verified first. The verification process is the most important. The platform is not going to look into your credit score but will judge you based on reputation. Once you verify your account it is advised that you wait at least a week before asking for a loan so you explore all the features that the platform provides.

So, how to get a Bitcoin loan? You actually have seven types of loans to choose from (six for verified customers). The important thing here is building your reputation so investors can trust you. Lenders can start with a few reputation bundling loans that are offered at 10+% ARP. However, the exact amount will still depend on the borrower and their stats.

Lenders need to open the loan listing and browse for available requests. The system will automatically generate a rating based on the information users have provided. The investors will overview the created requests and will choose the ones they feel safe investing in.

Things We Liked & Things We Didn’t Like

BtcPop is not your typical platform for lending. It is a community-based platform which is something that we very much like. The idea of being able to acquire a loan based on your reputation is a great one. The fact that many scammers have been able to misuse this feature has been somewhat resolved by tightening up security and introducing new safety features.

All in all, we like the philosophy behind BtcPop lending but we don’t like the fact that it can be abused by scammers.

Support

BtcPop has one of the fastest and most thorough support teams out of all the sites that we’ve checked. They thoroughly answered all the crypto lending questions we had that we had for them. Requests are done through tickets but the answers come almost instantaneously, explained in a very polite, professional and to-the-point manner.

Pricing/Fees

Since BtcPop is all about building your reputation, until you get to a higher level, the fees will differ. Starters get first-time loan rates that will later change. For collaterals over 200% of the requested amount, the APR is 10 – 15%. Collaterals over 100% of the requested amount, the APR is 15 – 25%. Finally, for collaterals over 25% – 75% of the requested amount, the APR is 20 – 45%.

| Pros | Cons |

| Your loans depend on your reputation to pay up | You need to register to the platform the learn all the details (exact rates and interests) |

| Deals with other crypto services like Bitcoin exchange or staking | One has to build up their reputation in order to qualify for a favorable interest rate |

| Instant deposits | Questionable security |

Based on the type of service you select the fees also differ. Crypto loans without collateral are 4% of the loaned amount. Loans without unified collateral are 3% of the loan amount. Finally, loans with verified collateral are 2% of the loan amount.

Our Verdict

BtcPop is not your everyday crypto-asset lending platform but a trust-based community. The user base is still small and because of that the process of getting a loan is not instant, but it is an interesting way of borrowing and lending bitcoin.

Reasons to Use

If you are willing to invest some time and don’t need a loan right away, BtcPop definitely has something to offer. If you want safety and trustworthiness, BtcPop has something for you.

- Free trial: No

- Lenders can withdraw money at any time: Yes

- Platform charges: No fees

- Loan duration: from 1 month to 3 years

- Interest rate: 4.5% p.a. - 4.95% p.a.

- Deposit limit: The minimum deposit amount is determined by the asset value, but generally amounts to $100

- Accepts multiple cryptocurrencies: Yes

CoinLoan is one of the first P2P lending platforms for crypto assets. It does not only help you manage your cryptoassets, but also provides a high level of security not many are capable of. The site is not only designed for helping crypto investors manage digital assets but also secures the collateral issued by the borrowers completely.

It offers some of the best crypto interest rates, and allows borrowers to automatically insure their damage if they fail to pay their interest on time. CoinLoan also aims at using different technologies to help their clients do their business better.

How to Apply

The application process on the CoinLoan peer lending platform is very similar to any other. Creating the account and getting verified takes mere minutes. Once you are done with all of that, simply click the “Lend” option. It will allow you to create a custom loan where you can determine your parameters. Choose the lending amount, loan term, loan limit, the interest rate, set the repayment options and pick the allowed crypto collateral.

After inputting all the necessary data, summarize your loan offer and click “Loan Agreement” which will finalize and create your loan offer.

You also have to fund your wallet with altcoin collateral to become eligible for funding. This will determine the amount you can borrow based on the market value of your security.

Things We Liked & Things We Didn’t Like

What we liked about CoinLoan is the effort they put into organizing their platform. Also, you will feel much safer with them as you can always count on getting the borrower’s collateral if nothing else. So you don’t have to worry about unsecured Bitcoin loans. But if things go well, you stand to earn up to 70% LTV of the asset’s market value.

What we didn’t like is that there are not many lenders nor borrowers, which makes trading somewhat limited.

Support

The support team at CoinLoan offered us probably the best experience of every platform that we check. They are very responsive and polite. They answer almost instantaneously when contacted through the platform. You can also contact them by email, and they are quick to respond.

Pricing/Fees

CoinLoan is one of the best alternative Bitcoin lending options for lenders, as they are not required to pay any fees whatsoever. So no registration fees, no transaction fees, no deposits fees nor withdrawal fees.

The pricing for borrowers meanwhile varies depending on the loan terms.

| Pros | Cons |

| Digital asset secured loans mean a higher probability of payback | A lower volume of borrowers and investors compared to other platforms |

| Supports multiple currencies compared to other sites | Absence of a BuyBack guarantee |

| LTV of up to 70% | |

| Regulated under European legislation |

Our Verdict

CoinLoan is a veteran in this field and they prove it. The concept of combining P2P and cryptocurrency is really smart. It makes a lot of sense and you can see that it pays off.

The biggest concern, however, is that they might suffer from low liquidity. In that case, borrowers will suffer financially, but the investors are safe due to the collateral.

Reasons to Use

If you are considering P2P banking, then CoinLoan is definitely an option to shortlist. Combining P2P and cryptocurrencies is definitely a smart move on their part. Also, they are not imposing any parameters that you don’t want to accept. The flexibility of determining everything by yourself can go a long way.

Even with the low amount of loans available, CoinLoan still has enough to offer to people who need the assets, not to mention their multiple currency options.

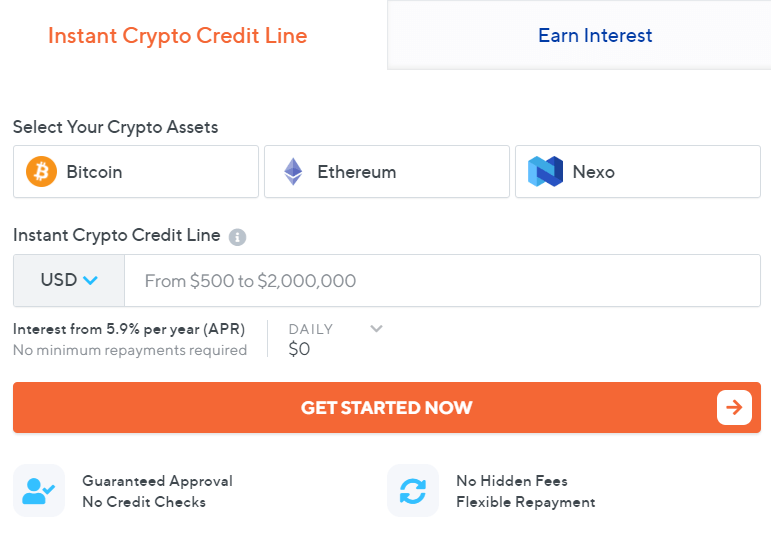

- Free trial: No

- Lenders can withdraw money at any time: Yes

- Platform charges: No charges

- Loan duration: Repay all or part of your loan at any time

- Interest rate: 0%-13.9% APR

- Deposit limit: $2 million

- Accepts multiple cryptocurrencies: Yes

Nexo was founded by Nexo Capital, or more precisely by TechCrunch founder Michael Arrington in 2017. As a multi-function lending platform, it not only provides P2P services, but also combines LTV and collateralized loans. That said, cryptocurrency remains their main focus, with Nexo Bitcoin lending their prime offering.

Currently, Nexo caters to the needs of more than 4 million customers worldwide. It additionally supports over 40 fiat currencies.

How to Apply

Opening up a Nexo Bitcoin wallet is pretty easy and will only take you a few steps to complete. You start by signing up for an account and filling in the necessary information. To get a loan you have to fund it with the cryptocurrency of your choice. Nexo supports BTC, XRP, ETH, LTC, BCH, XLM, EOS, BNB, TRX, and NEXO, as well as some stablecoins.

The next step involves going through a verification process, which you may do in the “My Profile” section. Once your loan is approved and you get the funds you need, you can withdraw them at any time by choosing the withdrawal method to obtain Nexo Bitcoin cash.

Nexo users have the option to deposit their preferred fiat currency or stablecoin so they gain interest. Lenders can in turn deposit different cryptocurrencies as collateral and qualify for a fiat currency loan.

Things We Liked & Things We Didn’t Like

What we liked about Nexo is their level of professionalism. They truly make users feel safe when using their services thanks to the platform’s military-grade security. For that reason, theirs are probably the safest Bitcoin wallets that you can find.

On the flip side, something that is not going to be beneficial for the borrowers is the comparatively higher interest rates. Also, you cannot really earn interest on cryptocurrencies that are not stablecoins.

But Nexo balances everything out with safety, flexibility and a lot more compromises than the completion.

Support

The support team was rather unhelpful as they mostly replied by sending automated messages. This can lead to a lot of confusion if you are unsure about what you are looking for.

Pricing/Fees

Nexo has set its cryptocurrency lending range between $500 (fiat) and $50 (stablecoins) and $2 million. The LTV ration then ranges from 25% to 60% of deposited assets.

Loan terms meanwhile start from 0% APR, which is the lowest you can get.. Interest, however, is charged for the days you borrow and also on the money you use.

|

Pros |

Cons |

| Supports LTV and collateralized loans in addition to cryptocurrency loans | Higher interest rates compared to other platforms |

| Offers more fiat currencies that rivals | |

| Very high insurance coverage (up to $100 million) | |

| Above-average security |

Our Verdict

Nexo is arguably the best Bitcoin lending platform out there. You are not going to get rich off of it but you will definitely be able to get the amount of cryptocurrency you are aiming for. Highly professional and safe.

Reasons to Use

We recommend using Nexo due to its high safety and reliability. Not many platforms offer the security that they do.

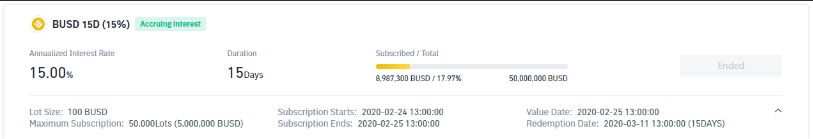

- Free trial: No

- Lenders can withdraw money at any time: No

- Platform charges: Includes fees based on VIP level (VIP 0-9) which also depends on the currency you are using. Includes spot trading fees, deposit and withdrawal fees.

- Loan duration: Choose from 7 to 180 days

- Interest rate: Daily interest rate 0.0244%, Annual interest rate 8.90%

- Deposit limit: No limit

- Accepts multiple cryptocurrencies: Yes

Binance is a company created by developer Changpeng Zhao in 2017. It is based in cayan Islands and even possesses its own cryptocurrency coin, Binance Coin (BNB), which is used for transactions and payments for fees on Binance.

Binance is one of the leading crypto-to-crypto exchange platforms and supports over a hundred of coins. Additionally, it offers some of the most favorable Bitcoin lending rates. Besides being able to cater to users from all over the world it recently partnered with Simplex to allow credit card purchases of crypto at a premium.

How to Apply

As one of the best Bitcoin lending exchange sites, Binance offers two types of lending – Fixed Deposits and Flexible Deposits. With the fixed ones you are supposed to lock your funds to a previously determined amount of time and interest. But the Flexible ones allow you to withdraw the funds whenever you want while the interest rate also changes over time.

After creating an account with Binance, find the “Products” bar and select one of the two mentioned above. After you select the product, simply subscribe your crypto to it and you are ready to loan.

Things We Liked & Things We Didn’t Like

What’s great about Binance is that they regularly update their coin value and are able to offer updated interest rates on each one. They are also able to introduce new coins for lending. The platform consistently evaluates new coins and tokens based on demand. So it would be wise to hold on to your coins that you wanted to get rid of because you just might get to use them here.

While they provide one of the best Bitcoin wallets, they don’t trade in fiat currencies. We see this as a bit of a downside. Also, their support team was not as helpful as you would expect.

Support

The support team on Binance was able to answer our questions quickly, but with automated messages. So it still took us a lot of time to find the answers we needed. So, the support team should work on adding more personality to their services.

Pricing/Fees

The fees for Binance lending are the same as for Binance trading. Meaning that they employ a VIP tier system where rates and fees are determined based on your level (VIP 0-9). Both the fees and interest rates may differ due to the level and each asset has a different fee as well.

| Pros | Cons |

| Offers multiple cryptocurrencies | Not available in all states |

| Interest is determined based on an annualized interest rate within a 14-day maturity term | Users need to wait for the next day to withdraw assets from flexible deposit accounts if they are locked for the day |

| Great usability, both for experienced and beginner users |

Our Verdict

Binance provides a simple way to get an instant Bitcoin loan with no verification. They are an experienced trading platform already and are quickly becoming a good lending one as well.

Reasons to Use

One of the main reasons for using Binance as opposed to other platforms is the ease of use. They make things really simple. Beginners are welcome to try out it while experienced traders will benefit from their offers. It certainly does not hurt to explore Binance for your lending needs.

- Free trial: No

- Lenders can withdraw money at any time: Yes

- Platform charges: The interest fee for a loan is a one-time payment

- Loan duration: There is no limit but the borrower may keep the collateral for loans is not repaid

- Interest rate: Lenders determine the interest of their Bitcoin loan requirements

- Deposit limit: Not limit

- Accepts multiple cryptocurrencies: No

xCoins peer-to-peer platform allows anyone with a credit card and a PayPal account to use it. XCoins offers their clients the service of obtaining Bitcoin through PayPal. This is a great choice for people who prefer to complete their financial services market dealings through PayPal.

The platform is still fairly young as it was set up as recently as 2018. It was created by Sergey Nikitin who leveraged PayPal for these types of services. Now, lenders can borrow their Bitcoin and in return, they will get payments through PayPal at various interest rates.

How to Apply

You can either apply for a loan or for lending at xCoins. The buying process starts by setting up an account. You can then determine the number of Bitcoin you wish to buy and also choose the preferred payment method. When the process is done, you will receive the Bitcoin to your Bitcoin wallets, which you can later transfer to your own account.

As far as the lending process goes, besides setting up an account with xCoins you also need a PayPal account as well. You will need to deposit the amount of Bitcoin you wish to lend to your xCoins wallet. The minimum is $50 worth of Bitcoin. Create a listing by determining the interest rate and other needed parameters. The only thing you have to do next is wait for the buyers to come and you will receive your payment through your PayPal account.

Things We Liked & Things We Didn’t Like

xCoins definitely offers an easy way to get approved for crypto lending. Their P2P lending method puts them in a favorable position among users. We also like their security. The 2-tier encryption system is something that gives them an advantage. What’s also interesting is that on this platform, you are able to borrow Bitcoin using your credit card. It is something that most sites don’t support.

However, all the bad publicity surrounding xCoins is definitely a drawback. It’s also only available in select counties, rather than globally. PayPal meanwhile can freeze user accounts due to undefined deposits that they receive through these platforms.

Support

The xCoins support team is very responsive. They offer various methods of contact.

Pricing/Fees

xCoins does not offer free Bitcoin loans as there are certain fees that have to be paid. Borrowers need to pay an interest fee on their loans. This is done once the security deposit is made through PayPal or by credit card. Borrowers also need to pay fees for payment processing and loan origination. Additionally, any bank transfer fees that are incurred will also need to be taken care of.

| Pros | Cons |

| Very easy and quick verification | Not for beginners |

| Instantly receive Bitcoin upon lender payment | Certain issues with PayPal accounts |

| 2-factor authentication | Site issues and bugs |

| Good customer support | Bad publicity |

Our Verdict

xCoin seems like a legit platform and it definitely is. That said, all the negative publicity leaves a bad taste in the mouth. This is particularly due to the fact that your PayPal account can be frozen due to these types of transactions.

It nevertheless remains one of the best Bitcoin lending sites out there since it’s able to provide certain services that others may not. If your only way of obtaining Bitcoin is though PayPal, xCoins is definitely the platform that you should use.

A certain amount of risk for using it definitely exists and you should be aware that the fees can sometimes build up.

Reasons to Use

It provides a high-level of security. Also, not many platforms offer the option of obtaining crypto via PayPal or credit card.

- Free trial: No

- Lenders can withdraw money at any time: Yes

- Platform charges: Select field partners are charged a small service fee.

- Loan duration: Individually based on a schedule and on the borrower’s ability to repay.

- Interest rate: Depending on the borrower. Some even charge 0% interest. Most Kiva members do not receive interest and the site does not collect it from borrowers either.

- Deposit limit: No deposit limit, only a borrower’s from $25 to $10,000 depending on the approval

- Accepts multiple currencies: No

Kiva is not your traditional crypto lending site, it is actually an open ecosystem where lenders from different countries can come and create chances for borrowing. The project is available in more than 70 countries spread across five continents. The partners involved are mostly microfinance institutions, but there are some schools and public enterprises involved as well.

The aim of Kiva is to make lives better for people who need instant crypto credit lines access. Their mission also includes contributing to poverty reduction. Kiva provides quick access to loans to those who really need them and don’t have access to financial services. Most of their crypto backed loans are issued to finance education, agriculture, or various creative projects. The downside is that even though they don’t primarily deal with cryptocurrency, there are still ways of obtaining them with the help of Kiva.

How to Apply

To qualify for a loan with Kiva, you have to be a legitimate business that is not bankrupt. Since there is no credit score check, it offers a free Bitcoin loan without verification. Depending on a variety of factors, businesses can apply for a loan from $1,000 to $10,000.

In order to apply, you only need to create an account and enter the approval stage. You can enter a 15-day private funding period or a 30-day public funding one. Once the crowdfunding is finished, you will get your assets to your account in eight days.

Things We Liked & Things We Didn’t Like

Generally speaking, the idea behind Kiva is a really charitable one. Being able to provide cross-border lending to people and organizations that truly need them is really humane. That said, the waiting period is too long. If you are looking at obtaining assets fast, this is not the place to be.

Also, it seems that their reputation is dwindling as there are a lot of claims that their policy is not truly zero-interest as they claim.

Support

Kiva’s support team is doing a really good job. They were able to answer really fast and respond appropriately to the inquiry at hand.

Pricing/Fees

Very different from the Ethlend loan platform, for example, Kiva follows a zero-interest policy and also does not demand any fees. Besides no fees for interest, there are no origination fees and no fees for borrowing.

| Pros | Cons |

| Great for startups and small businesses | Not good for large corporations |

| No prepayment penalty nor additional fees | A rather long application process |

| No interest rates | One usually has to wait 1-3 months for funding |

| Great support service |

Our Verdict

The idea behind Kiva seems really great. A crowdfunding method seems to work well. But we are not entirely sure about the zero-interest policy that the site is proposing, especially given the rumors that seem to be floating around the company. All in all, it sounds like a good idea on paper.

Reasons to Use

Its policy makes Kiva one of the best Bitcoin lending sites. Making those in need a priority is pretty honorable.

- Free trial: No

- Platform charges: None

- Interest rate: 4.95%- 13.45%

- Accepts multiple cryptocurrencies: Yes

- Lenders can withdraw money at any time: Yes

- Loan duration: Up to one year

- Deposit limit: $101,000

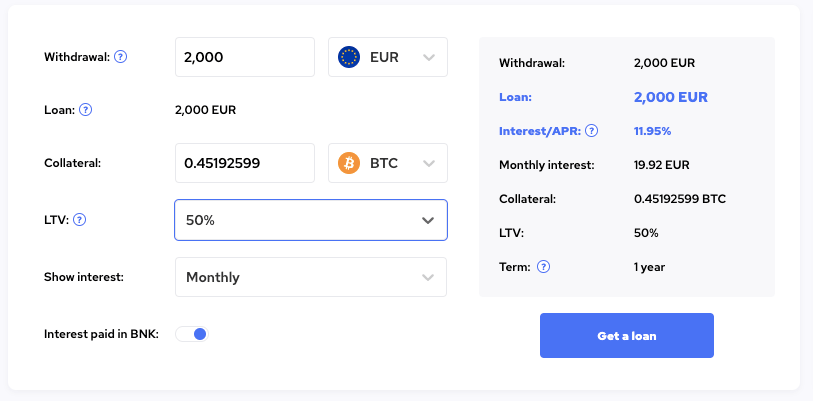

Founded in 2013 and headquartered in London, SpectroCoin is an all-in-one solution for cryptocurrencies. Most of its services are available in more than 200 countries around the world and include an electronic wallet, a prepaid debit card, currency exchange, a cryptocurrency brokerage, and merchant tools. Established with the idea to make financial transactions as easy as possible, SpectoCoin has recently partnered up with Bankera Loans to offer blockchain-based cryptocurrency loans.

How to Apply

The first step that you’ll need to take as a new user involves creating and verifying your SpectroCoin account. From there, you’ll be asked to deposit the assets that will be used as collateral. Next up, the platform will let you choose your loan terms (borrowing amount and currency, collateral amount and currency, and the loan-to-value ratio.) Once you’re done with adjusting the terms to your liking, you’ll be able to proceed with your loan request. Note that approval won’t take longer than a few seconds.

Over the course of loan repayment you’ll need to keep an eye on your loan-to-value ratio. We suggest you keep it under control by repaying the loan on time or increasing collateral if needed.

Things We Liked & Disliked

With loan amounts starting from $25 and going up to $1 million, SpectoCoin offers one of the market’s widest loan amount ranges. Other advantages include instant payouts, low fees, good LTV ratios, and a long list of accepted cryptocurrencies (Bitcoin, Ether, Tether, Dash, and more).

We didn’t like the fact that you’ll have to face higher interest charges if you decide not to pay interest in Bankera coins (BNK). Another drawback is that, while interest payments are debited automatically on a monthly basis, users need to make manual loan payments.

Support

As far as support goes, the company offers round-the-clock support via live chat and email. Additionally, SpectroCoin’s help page provides a comprehensive library of frequently asked questions and answers.

Pricing/Fees

As one of the top Bitcoin lending platforms, SpectroCoin offers excellent deals on crypto-backed loans. Interest rates start from 4.95% and go up to 13.45%. There are no other hidden fees. You can opt for an LTV ratio of 25%, 50%, or 75%. Loan amounts range between $25 and $1 million. Loans are issued for a period of one year but can be repaid early with no prepayment penalties. Also, note that loan periods are extendable.

| Pros | Cons |

| Competitive loan terms | Loan payments are done manually |

| Loans can be repaid in euro or cryptocurrency | Customer support is below average |

| No prepayment penalties | |

| Easy application process |

Our Verdict

Getting a crypto-backed loan via SpectroCoin is as easy as creating an account, depositing some assets as collateral, choosing the most suitable loan terms, and clicking the ‘get a loan’ button. Approvals and funding times are almost instantaneous. The platform is neatly designed and easy to get around. But, customer service could be quicker in their response time.

Reasons to Use

SpectroCoin stands out in the crowded crypto-backed lending market for its wide range of loan amounts, relatively low fees, and long list of accepted cryptocurrencies.

- Free trial: No

- Platform charges: None

- Interest rate: 0% + 2.5% origination fee on quick loans and 8% + origination fee on flexible loans

- Accepts multiple cryptocurrencies: Yes

- Lenders can withdraw money at any time: Yes

- Loan duration: 1-36 months

- Deposit limit: No limits

Launched in 2014, Nebeus has grown substantially ever since. Today the company offers a wide range of crypto-related products and services, such as instant crypto-backed loans, an online wallet, savings accounts, cold vault storage, and the ability to buy and sell cryptocurrency in a fast and convenient way. Nebeus aims to bridge the gap between traditional financial markets and digital assets. It’s services are available to users from more than 100 countries.

How to Apply

Anyone who’s looking to keep their cryptocurrency safe and leverage its value without having to sell is eligible for Bitcoin- or Ether-backed loans from Nebeus.

The application process is easy and straightforward. First of all, you need to open a Nebeus account. The whole procedure is completely free and takes about 10 minutes. After that you’ll be asked for a security deposit. Note that Nebeus accepts Bitcoin, Ether, and Nebeus tokens as collateral. Then you’ll be able to choose your preferred loan terms and request funding. The approval process is incredibly fast and the funds are usually made available to the user in less than five minutes.

Things We Liked & Disliked

One of the best things about Nebeus is that it provides a Loan Health Monitor to all of its users. This tool lets users keep an eye on their loan-to-value ratio. If the price of the cryptocurrency put up as collateral starts to decrease, the user can react immediately by making a payment or adding more collateral to reduce risks.

On the downside, compared to most of its direct competitors, Nebeus has a much more complicated verification process. We didn’t like that users need to verify their identity via SMS, send a scan of your ID, and submit a copy of a recent utility bill to prove their address just to open an account.

Support

As far as support goes, Nebeus has a comprehensive help page that provides answers to the most frequently asked questions in English and Spanish. For those who can’t find the solution for their problems on the help page, there’s an option to add a ticket.

Pricing/Fees

Nebeus is a peer-to-peer lending platform which means that the interest rates vary from lender to lender. In most cases, interest charges range between 0% + 2.5% origination fee on quick loans and 8% + origination fee on flexible loans. Loan-to-value ratio options range between 50% and 80%. The minimum loan amount is 0.005 BTC, while the maximum is 20 BTC. Loan terms range between one month and 36 months. There are no prepayment penalties if the loan is repaid in full in the first 30 days of the term.

| Pros | Cons |

| 50%- 80% loan-to-value ratio | Complicated account verification process |

| Loan Health Monitor | Fees can be high with some lenders |

| Flexible repayment options | |

| Available to users from almost 150 countries |

Our Verdict

The Nebeus cryptocurrency platform seems to be a well-rounded option with numerous helpful crypto-related services that users can take advantage of, in addition to crypto-collateralized loans. Its loan-to-value ratio crypto-backed loans are among the industry’s highest, and the overall loan process is fairly easy to get through. However, given that this is a peer-to-peer lending platform, borrowing costs can vary widely from lender to lender, so we suggest you make sure that you are fully aware of all the costs you may have to face.

Reasons to Use

Nebeus is an excellent choice if you’re looking to get a fast and relatively inexpensive crypto-collateralized loan with a high loan-to-value ratio.

- Free trial: No

- Platform charges: None

- Interest rate: 11%-15%

- Accepts multiple cryptocurrencies: No

- Lenders can withdraw money at any time: Yes

- Loan duration: 6-36 months

- Deposit limit: No limits

Launched in 2017 in Austin, Texas, Unchained Capital is a blockchain financial services company that offers crypto-collateralized loans. The company specializes in providing cash loans to long-term cryptocurrency holders in a fast, secure, and completely transparent manner, backed by an innovative multi-signature cold-storage custody solution.

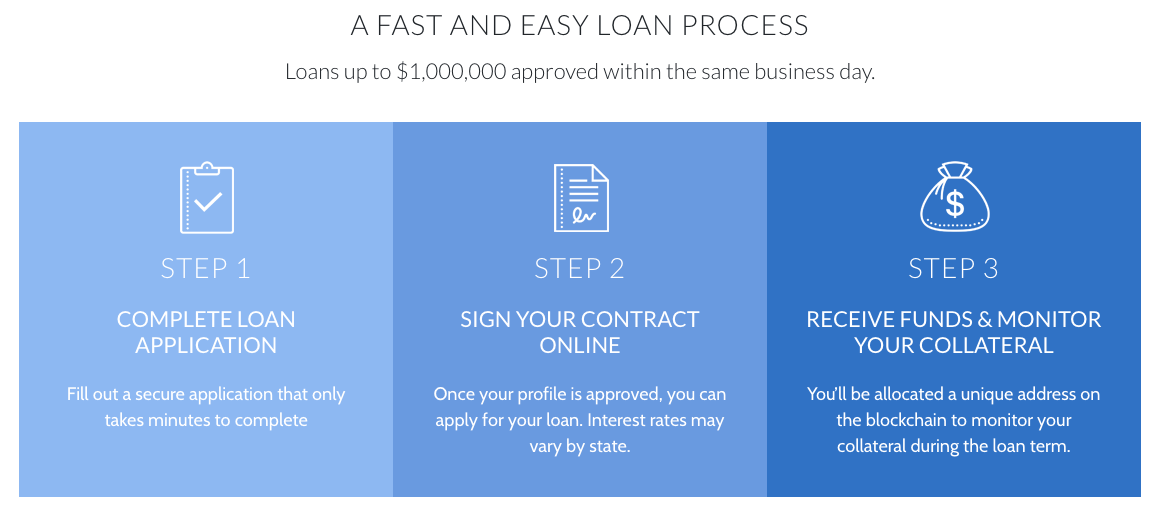

How to Apply

Applying for Unchained Capital’s crypto-secured loans is fast and simple. The first step involves filling out a secure online form. This shouldn’t take you more than a few minutes. From there, you’ll be able to choose among the provider’s predetermined loan plans. Next, you’ll proceed to contract signing. Once your application is approved, you’ll get the funds almost instantly. You’ll also receive a unique address that you’ll use to monitor your collateral during the loan term.

Things We Liked & Disliked

One of best things about Unchained Capital’s loans is that the approval process does not involve credit checks. We also liked the fact that the site employs some of the industry’s highest security standards. Other great things include the lack of prepayment fees and the ability to monitor the changes in your loan-to-value ratio.

As far as drawbacks go, Unchained Capital’s private loans are only available to US customers. Also, we didn’t like that the lowest amount that you can take out is $10,000 for individual borrowers and $100,000 for businesses.

Support

Should you have any questions or stumble upon any issues, Unchained Capital’s customer service team will be there to assist you. Support channels include phone, email, and live chat. The site also has a help page with a huge library of frequently asked questions and answers.

Pricing/Fees

As one of the best Bitcoin lending sites, Unchained Capital offers excellent loan terms both for its private and commercial clients. Interest rates are fixed and typically range between 11% and 15%, while the loan-to-value ratio is 40%. Customers can opt for a loan term as short as three months and as long as 36 months, while even longer periods can be approved if you make a special request. As far as loan amounts go, private loans range between $10,000 and $1,000,000, while commercial loans start at $100,000 and can also go up to $1,000,000.

| Pros | Cons |

| Quick and easy online application process | Private loans only available to US citizens |

| Funds are available almost instantly | High minimum loan amounts |

| High level of security | |

| Commercial loans are available worldwide |

Our Verdict

Unchained Capital lets its customers borrow US dollars against cryptocurrency – all with a focus on excellent customer service and complete transparency. What makes this company’s offer unique are the multisignature cold storage solutions that ensure maximum security for your cryptocurrency. Unchained Capital offers crypto-collateralized loans to individuals and businesses, and the only drawback is that funding for individuals is only available for US clients.

Reasons to Use

Given its fast and easy loan application process, high level of security, and competitive rates, Unchained Capital is a good choice for crypto-backed loans.

- Free trial: No

- Platform charges: None

- Interest rate: 0.001% to 0.003%

- Accepts multiple cryptocurrencies: Yes

- Lenders can withdraw money at any time: Yes

- Loan duration: 7-28 days

- Deposit limit: No limits

Launched in 2017, KuCoin has quickly established itself as a global exchange platform for digital assets and cryptocurrencies. In addition to convenient and secure exchange services, the site also provides options for trading and lending.

How to Apply

KuCoin lets its clients lend limited cryptocurrency to other clients for margin trading and to charge interest. As a borrower, you’ll need to open and verify your KuCoin account. Next up, you’ll need to put up some digital assets as collateral. From there, you’ll be able to access your trading dashboard and expand the ‘borrow’ section. Next, you’ll be asked to choose the cryptocurrency you’d like to borrow, your borrowing amount, interest rate, loan-to-value ratio, and the loan term. After completing your crypto loan application you’ll need to wait for approval, which won’t take more than a few minutes.

Things We Liked & Disliked

One of the best things about KuCoin is that it lets you borrow various types of cryptocurrency including BTC, USDT, ETH, EOS, LTC, XRP, ADA, ATOM, TRX, BCHABC, BCHSV, ETC, DASH, ZEC, XLM, VET, LUNA, and DOT. We also liked the quick application process and fast approval.

As far as drawbacks go, we didn’t like the lack of longer-term loans and that the fees can vary from lender to lender.

Support

You can get in touch with KuCoin’s technical support team via email or live chat. You can also submit a ticket on the website. Before you do so, be sure to first check out the site’s detailed help page to see if it can answer any of your questions.

Pricing/Fees

As far as borrowing fees go, daily interest rates start at 0.001% and can go up to 0.003%. Customers can take out a loan with a 25%, 50%, 75%, or 100% loan-to-value ratio. When it comes to loan duration, KuCoin only offers short-term loans. Borrowers can opt for a seven-, 14-, or 28-day term. Given that the platform operates as a peer-to-peer crypto-lending marketplace, loan amounts can vary from contract to contract. However, they usually range between $100 and $1,500,000.

| Pros | Cons |

| A wide range of accepted cryptocurrencies | No long-term loan options |

| Loan-to-value ratio goes up to 100% | Interest rates can vary from lender to lender |

| Quick and easy application | |

| Fast funding |

Our Verdict

With more than five million registered users from 207 countries and regions accumulated in the three years since its launch date, it’s safe to say that KuCoin is an industry leader. The company focuses on cryptocurrency exchange and trading, but it also works as an excellent lending platform. One of its strongest points is that it accepts a long list of different cryptocurrencies, while its biggest drawback is that it only allows short-term loans.

Reasons to Use

We suggest you give KuCoin a chance for its huge array of accepted cryptocurrencies, high loan-to-value ratio, and quick and easy application process.

- Free trial: No

- Platform charges: None

- Interest rate: 0.011-0.2% (daily)

- Accepts multiple cryptocurrencies: Yes

- Lenders can withdraw money at any time: Yes

- Loan duration: 1-30 days

- Deposit limit: No limits

Described as a place where early adopters trade and invest in cryptocurrency, CoinList offers a platform for digital asset companies to run their token sales. The San Francisco-based company has also recently launched CoinList Lend, a service geared towards customers looking to earn a passive return on their digital assets.

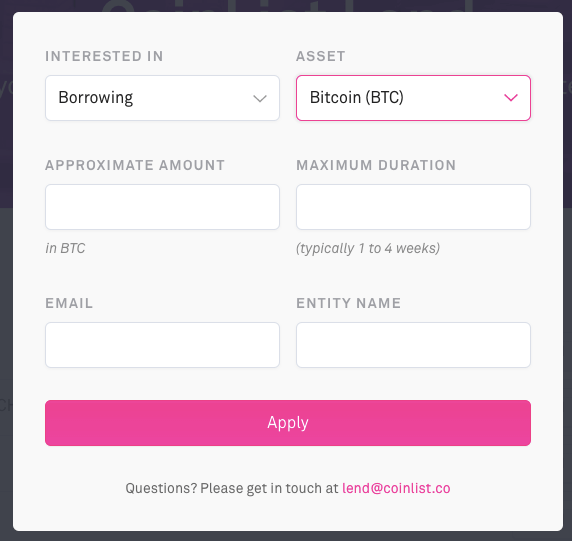

How to Apply

Before you can apply for a loan offered through CoinList Lend, you need to sign up for a Coinlist account. The application process is fairly easy – all you have to do is provide your name and email. From there, you’ll be asked to verify your account by submitting a copy of your picture ID and a proof of residence. As soon as the verification process is completed, you’ll be able to deposit your digital assets as collateral and request your desired loan amount.

Things We Liked & Disliked

One of the best things about CoinList is that it lets its customers lend and borrow 10 different crypto assets: ALGO, BCH, BTC, ETH, LTC, MKR, WBTC, XRP, XTZ, and ZRX. We also liked that both parties remain anonymous to each other throughout the loan term.

On the downside, borrowers can’t opt for a loan term longer than 30 days, and interest rates on certain loan types tend to be high.

Support

Should you have any questions or stumble upon any issues, the options to get help include consulting CoinList’s FAQ page or getting in touch with the company’s customer support representatives via email or Twitter.

| Pros | Cons |

| Accepts 10 different cryptocurrencies | High interest rates for loans in Tezos (XTZ) and Algo (ALGO) |

| Borrowers and lenders are anonymous | Only short-term loans are offered |

| Quick-to-respond customer support | |

| Relatively low interest rate on most loan types |

Pricing/Fees